McAllen, Texas - Net Lease Properties news today is from the great state of Texas. McAllen is about 157 miles south west of Corpus Christi, Texas. An undisclosed developer has sold a Kohl's Net Leased Property to a private buyer for $7.3 million.

Kohl’s had recently signed a 20-year Triple Net Lease (NNN) with 5 percent rent increases between each of the six five-year options. This net lease investment is 88,248 square feet and is located in Trenton Crossing. The property address is 7900 N. 10th Street.

Some other net lease properties at Trenton Crossing are Old Navy, Office Max, Best Buy and Ross Dress for Less. Many Kohl's net leased properties, in Florida are near Super Target and/or Super Wal-Mart.

NNN Leased Property for a 1031 Exchange

Kohl's had recently rated as the 6th largest retailer with a BBB+ credit rating from S&P. Triple Net Lease Properties are an ideal debt replacement Vehicle for commercial real estate investors using a 1031 tax deferred exchange.

Feel free to check out the Featured Commercial Property For Sale.

If you are considering purchasing Commercial Real Estate or a Triple Net Leased Property, you can apply for CTL Financing with Loanrise.com. Loanrise.com can also help with Mezzanine Loans. Multifamily Apartment Building Loans and Non Recourse Loans are available through Commercial Loans at Loanrise.com.

Tuesday, August 31, 2010

Monday, August 30, 2010

1031 Tax Deferred Exchange with Industrial Property

Denver, Colorado - Net Lease Properties news today is on a 1031 tax deferred exchange. Pinnacle Real Estate Advisors announced the sale of the Goodyear-Wingfoot tire- retreading plant at 4970 Cook Street, in Denver.

This Industrial Property sold for $1.5 million in a 1031 exchange, with the tire company remaining as the tenant leasing the property.

This Industrial Property was recently holding an asking price of $1.7 million. The Industrial property is 20,000-square-foot and occupies 2.47 acres. The single-story industrial building was completed in 1999.

There are plenty of benefits of Net Lease Investments such as using a 1031 tax deferred exchange. Unlike other investments, commercial real estate is a great tax saver and helps you eradicate capital gains tax by using the 1031 tax deferred exchange.

A brief description of a 1031 exchange is that a 1031 allows commercial real estate owners to exchange properties of equal or greater value. The Commercial Real Estate Investors can the defer capital gains tax, if the 1031-exchange is performed properly. The tax is paid when the commercial property is sold in a standard sale.

Triple Net Lease Properties are an ideal debt replacement Vehicle for 1031 Investors.

Here are some of the Retail Single Tenants that may be available as a Net Lease Investment or Triple Net Lease Property:

•AutoZone Net Lease Investment

•Burger King Net Lease Investment

•Costco Net Lease Investment

•CVS Net Lease Investment

•FedEx Net Lease Investment (Federal Express Net Lease Investment)

•Home Depot Net Lease Investment

•Kohl’s Net Lease Investment

•Kroger Net Lease Investment

•Lowe’s Net Lease Investment

•McDonald’s Net Lease Investment

•Oreilly’s Net Lease Investment

•Publix Net Lease Investment

•Safeway Net Lease Investment

•Staples Net Lease Investment

•Steak n' Shake Net Lease Investment

•Target Net Lease Investment

•Walgreens Net Lease Investment

•Wal-Mart Net Lease Investment

•Wendy's Net Lease Investment

If you are considering purchasing Commercial Real Estate or a Triple Net Leased Property, you can apply for CTL Financing with Loanrise.com. Loanrise.com can also help with Mezzanine Loans. Mezzanine Financing and Non Recourse Loans are available through Commercial Loans at Loanrise.com.

This Industrial Property sold for $1.5 million in a 1031 exchange, with the tire company remaining as the tenant leasing the property.

This Industrial Property was recently holding an asking price of $1.7 million. The Industrial property is 20,000-square-foot and occupies 2.47 acres. The single-story industrial building was completed in 1999.

There are plenty of benefits of Net Lease Investments such as using a 1031 tax deferred exchange. Unlike other investments, commercial real estate is a great tax saver and helps you eradicate capital gains tax by using the 1031 tax deferred exchange.

A brief description of a 1031 exchange is that a 1031 allows commercial real estate owners to exchange properties of equal or greater value. The Commercial Real Estate Investors can the defer capital gains tax, if the 1031-exchange is performed properly. The tax is paid when the commercial property is sold in a standard sale.

Net Lease Properties

If a Net Lease Property is of interest to you then contact us, HERE. We can assist you with your search for Net Lease Property Investments.Triple Net Lease Properties are an ideal debt replacement Vehicle for 1031 Investors.

Here are some of the Retail Single Tenants that may be available as a Net Lease Investment or Triple Net Lease Property:

•AutoZone Net Lease Investment

•Burger King Net Lease Investment

•Costco Net Lease Investment

•CVS Net Lease Investment

•FedEx Net Lease Investment (Federal Express Net Lease Investment)

•Home Depot Net Lease Investment

•Kohl’s Net Lease Investment

•Kroger Net Lease Investment

•Lowe’s Net Lease Investment

•McDonald’s Net Lease Investment

•Oreilly’s Net Lease Investment

•Publix Net Lease Investment

•Safeway Net Lease Investment

•Staples Net Lease Investment

•Steak n' Shake Net Lease Investment

•Target Net Lease Investment

•Walgreens Net Lease Investment

•Wal-Mart Net Lease Investment

•Wendy's Net Lease Investment

If you are considering purchasing Commercial Real Estate or a Triple Net Leased Property, you can apply for CTL Financing with Loanrise.com. Loanrise.com can also help with Mezzanine Loans. Mezzanine Financing and Non Recourse Loans are available through Commercial Loans at Loanrise.com.

Sunday, August 29, 2010

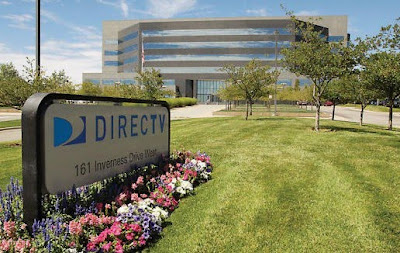

Net Leased Office Building Sold for $48 Mil

Denver, Colorado - Net Lease Properties has news on one of the largest commercial real estate transactions this year in the Denver, Colorado area. Arapahoe County records show that Dividend Capital Total Realty Trust Inc. purchased the 161 Inverness Office Building for $48 million. This net leased office building is 216,500 square-feet and was built in 1998. It is fully leased by DirecTV for the next few years, as TRT NOIP Inverness Englewood LLC. The net leased office building is located at 161 Inverness Dr. W. in the Inverness office park.

This commercial real estate transaction is part of Dividend Capital’s recently closed, $1.35 billion acquisition of 32 office and industrial properties.

The seller of these income producing properties was iStar Financial Inc., who are based in New York.

IStar formerly was Starwood Financial Inc., completed the sale of a portfolio of 32 corporate tenant lease properties (CTL Properties) resulting in net proceeds of $1.33 billion. The term corporate tenant lease (CTL) properties is used by iStar in their financial announcements. We "Net Lease Properties" use the term "CTL Properties" as meaning Credit Tenant Lease Properties. A $105.6 million mezzanine loan associated with the CTL portfolio sale was offered.

Net Lease Properties & Commercial Loans

If a Net Lease Property is of interest to you then contact us, HERE. We can assist you with your search for Net Lease Property Investments. If you are considering selling your Commercial Real Estate, you might want to consider doing a 1031 exchange (1031 tax deferred exchange). Triple Net Lease Properties (NNN) are an ideal debt replacement Vehicle for 1031 Investors.If you are considering purchasing Commercial Real Estate or a Triple Net Leased Property, you can apply for CTL Financing with Loanrise.com. Loanrise can also help with Mezzanine Loans and Office Building purchase loans. Mezzanine Financing and Non Recourse Loans are available through Commercial Loans at Loanrise.com.

Friday, August 27, 2010

Single Tenant Net Lease Funds Each Amass $300 Mil

New York, NY - Net Lease Properties has news today on Net Lease Funds. Two funds which are sponsored by Fortress Investment Group LLC have each amassed $300 million, according to recent SEC filings.

Fortress Investment Group LLC was founded in 1998. Fortress Investment Group LLC is a global investment manager for institutional and private investors, with approximately $41.7 billion of net assets under management.

The funds are Fortress Net Lease Funds 1(A) and 1(B) which are private equity style funds. These Net Lease Funds invest in a diversified pool of single tenant net lease assets.

A net lease property transaction that we watched closely a few years ago, involved, Fortress Investment Group, LLC. A Company that acquired 144 Buffets/Ryan's restaurant properties in connection with affiliates of Fortress Investment Group, LLC for approximately $348 million took place. The properties are being leased to subsidiaries of Buffets, Inc. and guaranteed by Buffets, Inc. under an average of 20-year, net-lease agreements.

Net Lease Properties are an ideal debt replacement Vehicle for 1031 Investors and for Net Lease Funds to invest in.

If you are considering purchasing Commercial Real Estate or a Triple Net Leased Property, you can apply for CTL Financing and Commercial Loans at Loanrise.com.

Here are some of the Retail Single Tenants that may be available as a Net Lease Investment or Triple Net Lease Property:

•AutoZone Net Lease Investments

•Burger King Net Lease Investments

•Costco Net Lease Investments

•CVS Net Lease Investments

•FedEx Net Lease Investments (Federal Express Net Lease Investments)

•Home Depot Net Lease Investments

•Kohl’s Net Lease Investments

•Kroger Net Lease Investments

•Lowe’s Net Lease Investment

•McDonald’s Net Lease Investments

•Oreilly’s Net Lease Investments

•Publix Net Lease Investments

•Safeway Net Lease Investments

•Staples Net Lease Investments

•Steak n' Shake Net Lease Investments

•Target Net Lease Investments

•Walgreens Net Lease Investments

•Wal-Mart Net Lease Investments

•Wendy's Net Lease Investments

If a Net Lease Property is of interest to you then contact us, HERE.

Fortress Investment Group LLC was founded in 1998. Fortress Investment Group LLC is a global investment manager for institutional and private investors, with approximately $41.7 billion of net assets under management.

The funds are Fortress Net Lease Funds 1(A) and 1(B) which are private equity style funds. These Net Lease Funds invest in a diversified pool of single tenant net lease assets.

A net lease property transaction that we watched closely a few years ago, involved, Fortress Investment Group, LLC. A Company that acquired 144 Buffets/Ryan's restaurant properties in connection with affiliates of Fortress Investment Group, LLC for approximately $348 million took place. The properties are being leased to subsidiaries of Buffets, Inc. and guaranteed by Buffets, Inc. under an average of 20-year, net-lease agreements.

Net Lease Properties are an ideal debt replacement Vehicle for 1031 Investors and for Net Lease Funds to invest in.

Net Lease Properties & Commercial Loans

If a Net Lease Property is of interest to you then contact us, HERE. We can assist you with your search for Net Lease Property Investments. Some examples of net leased properties to purchase are listed below.If you are considering purchasing Commercial Real Estate or a Triple Net Leased Property, you can apply for CTL Financing and Commercial Loans at Loanrise.com.

Here are some of the Retail Single Tenants that may be available as a Net Lease Investment or Triple Net Lease Property:

•AutoZone Net Lease Investments

•Burger King Net Lease Investments

•Costco Net Lease Investments

•CVS Net Lease Investments

•FedEx Net Lease Investments (Federal Express Net Lease Investments)

•Home Depot Net Lease Investments

•Kohl’s Net Lease Investments

•Kroger Net Lease Investments

•Lowe’s Net Lease Investment

•McDonald’s Net Lease Investments

•Oreilly’s Net Lease Investments

•Publix Net Lease Investments

•Safeway Net Lease Investments

•Staples Net Lease Investments

•Steak n' Shake Net Lease Investments

•Target Net Lease Investments

•Walgreens Net Lease Investments

•Wal-Mart Net Lease Investments

•Wendy's Net Lease Investments

If a Net Lease Property is of interest to you then contact us, HERE.

Thursday, August 26, 2010

CVS Triple Net Leased Properties Sold, ideal for 1031 Investors

Tulsa, Oklahoma - Net Lease Properties news for the day is on a Net Lease Investment portfolio. A net lease brokerage firm negotiated the sale of the CVS portfolio to a private investor for the amount of $62.7 Million. This CVS Net leased portfolio consists of 20 retail properties. These CVS net leases are on properties with a total of 248,000 square feet.

The net lease investment portfolio contains CVS net lease properties in Florida, Michigan, California, Georgia, Alabama, Connecticut, Illinois, Massachusetts, New Hampshire, Pennsylvania, Texas and Virginia.

CVS is one of the largest pharmacy health care providers in the Country.

If you are considering purchasing Commercial Real Estate or a Triple Net Leased Property, you can apply for CTL Financing. Loanrise can also help with Mezzanine Loans. Mezzanine Financing and Non Recourse Loans are available through Commercial Loans at Loanrise.com.

Triple Net Lease Properties are an ideal debt replacement Vehicle for 1031 Investors.

Here are some of the Retail Single Tenants that may be available as a Net Lease Investment or Triple Net Lease Property:

•AutoZone Net Lease Investment

•Burger King Net Lease Investment

•Costco Net Lease Investment

•CVS Net Lease Investment

•FedEx Net Lease Investment (Federal Express Net Lease Investment)

•Home Depot Net Lease Investment

•Kohl’s Net Lease Investment

•Kroger Net Lease Investment

•Lowe’s Net Lease Investment

•McDonald’s Net Lease Investment

•Oreilly’s Net Lease Investment

•Publix Net Lease Investment

•Safeway Net Lease Investment

•Staples Net Lease Investment

•Steak n' Shake Net Lease Investment

•Target Net Lease Investment

•Walgreens Net Lease Investment

•Wal-Mart Net Lease Investment

•Wendy's Net Lease Investment

If a Net Lease Property is of interest to you then contact us, HERE.

The net lease investment portfolio contains CVS net lease properties in Florida, Michigan, California, Georgia, Alabama, Connecticut, Illinois, Massachusetts, New Hampshire, Pennsylvania, Texas and Virginia.

CVS is one of the largest pharmacy health care providers in the Country.

Net Lease Properties & Commercial Loans

If a Net Lease Property is of interest to you then contact us, HERE. We can assist you with your search for Net Lease Property Investments. Some examples of net leased properties to purchase are listed below.If you are considering purchasing Commercial Real Estate or a Triple Net Leased Property, you can apply for CTL Financing. Loanrise can also help with Mezzanine Loans. Mezzanine Financing and Non Recourse Loans are available through Commercial Loans at Loanrise.com.

Triple Net Lease Properties are an ideal debt replacement Vehicle for 1031 Investors.

Here are some of the Retail Single Tenants that may be available as a Net Lease Investment or Triple Net Lease Property:

•AutoZone Net Lease Investment

•Burger King Net Lease Investment

•Costco Net Lease Investment

•CVS Net Lease Investment

•FedEx Net Lease Investment (Federal Express Net Lease Investment)

•Home Depot Net Lease Investment

•Kohl’s Net Lease Investment

•Kroger Net Lease Investment

•Lowe’s Net Lease Investment

•McDonald’s Net Lease Investment

•Oreilly’s Net Lease Investment

•Publix Net Lease Investment

•Safeway Net Lease Investment

•Staples Net Lease Investment

•Steak n' Shake Net Lease Investment

•Target Net Lease Investment

•Walgreens Net Lease Investment

•Wal-Mart Net Lease Investment

•Wendy's Net Lease Investment

If a Net Lease Property is of interest to you then contact us, HERE.

Wednesday, August 25, 2010

Net Lease Investment with Walgreen's as Tenant

Pickerington, Ohio - Net Lease Properties has information on a Walgreen's net lease investment. A Net Lease Investment with over 10 years left on lease, sold for $6,806,557. The Walgreen's net leased property is located at 1101 Hill Road, in Pickerington, Ohio. This is a newly constructed, free standing building, approximately 14,490 square feet of net lease investment.

The city of Pickerington is located just east of Columbus, Ohio. This Walgreens net lease property is in Fairfield County. The city features a historic downtown shopping district and a strong retail corridor on Hill Street. This net lease site is located at the North west corner of Hill and Refugee. The adjacent corners houses a CVS, McDonald's and BP gas station.

Some Walgreens have lease that are triple net leases and others are NN Net-Net Walgreen's. An example of a Double-Net NN Lease, Walgreens pays for all operating expenses on the property including real estate tax, insurance and CAM, with the exception of roof and structure.

If you are considering purchasing Commercial Real Estate or a Triple Net Leased Property, you can apply for CTL Financing. Loanrise can also help with Mezzanine Loans. Mezzanine Financing and Non Recourse Loans are available through Commercial Loans at Loanrise.com.

Here are some of the Retail Single Tenants that may be available as a Net Lease Investment or Triple Net Lease Property:

•AutoZone Net Lease Investment

•Burger King Net Lease Investment

•Costco Net Lease Investment

•CVS Net Lease Investment

•FedEx Net Lease Investment (Federal Express Net Lease Investment)

•Home Depot Net Lease Investment

•Kohl’s Net Lease Investment

•Kroger Net Lease Investment

•Lowe’s Net Lease Investment

•McDonald’s Net Lease Investment

•Oreilly’s Net Lease Investment

•Publix Net Lease Investment

•Safeway Net Lease Investment

•Staples Net Lease Investment

•Steak n' Shake Net Lease Investment

•Target Net Lease Investment

•Walgreens Net Lease Investment

•Wal-Mart Net Lease Investment

•Wendy's Net Lease Investment

If a Net Lease Property is of interest to you then contact us, HERE.

The city of Pickerington is located just east of Columbus, Ohio. This Walgreens net lease property is in Fairfield County. The city features a historic downtown shopping district and a strong retail corridor on Hill Street. This net lease site is located at the North west corner of Hill and Refugee. The adjacent corners houses a CVS, McDonald's and BP gas station.

Some Walgreens have lease that are triple net leases and others are NN Net-Net Walgreen's. An example of a Double-Net NN Lease, Walgreens pays for all operating expenses on the property including real estate tax, insurance and CAM, with the exception of roof and structure.

Net Lease Properties & Commercial Loans

If a Net Lease Property is of interest to you then contact us, HERE. We can assist you with your search for Net Lease Property Investments. Some examples of net leased properties to purchase are listed below.If you are considering purchasing Commercial Real Estate or a Triple Net Leased Property, you can apply for CTL Financing. Loanrise can also help with Mezzanine Loans. Mezzanine Financing and Non Recourse Loans are available through Commercial Loans at Loanrise.com.

Here are some of the Retail Single Tenants that may be available as a Net Lease Investment or Triple Net Lease Property:

•AutoZone Net Lease Investment

•Burger King Net Lease Investment

•Costco Net Lease Investment

•CVS Net Lease Investment

•FedEx Net Lease Investment (Federal Express Net Lease Investment)

•Home Depot Net Lease Investment

•Kohl’s Net Lease Investment

•Kroger Net Lease Investment

•Lowe’s Net Lease Investment

•McDonald’s Net Lease Investment

•Oreilly’s Net Lease Investment

•Publix Net Lease Investment

•Safeway Net Lease Investment

•Staples Net Lease Investment

•Steak n' Shake Net Lease Investment

•Target Net Lease Investment

•Walgreens Net Lease Investment

•Wal-Mart Net Lease Investment

•Wendy's Net Lease Investment

If a Net Lease Property is of interest to you then contact us, HERE.

Tuesday, August 24, 2010

Net Lease Investment Portfolio Sold

Lancaster, Pennsylvania - Net Lease Properties news today is on a net leased investment portfolio which was sold. Pennsylvania Real Estate Investment Trust (PREIT) sold the net leased investment portfolio for approximately $134 Million. RioCan Real Estate Investment Trust did a joint venture with Cedar Shopping Centers, Inc for this acquisition. These Companies purchased the portfolio of five net leased grocery anchored and retail centers located in Pennsylvania, Virginia, and New Jersey.

The five net lease properties include the following:

New River Valley Center is located in Christiansburg, Virginia, approximately 55 miles north of the Virginia / North Carolina state border. This leased retail center is in close proximity to Virginia Tech University. New River Valley is a 165,000 square foot new format retail center which was built in 2007. The tenants at the property include a 30,000 square foot Best Buy (lease carries to 2018), Old Navy, Ross Dress for Less, Bed Bath & Beyond, Staples, and PetSmart.

Pitney Road Plaza is located in Lancaster, Pennsylvania, which is situated midway between Philadelphia and Harrisburg Pennsylvania. Pitney Road Plaza is a new format, leased retail center and was constructed in 2009. The commercial real estate acquired is a 46,000 square foot freestanding Best Buy (lease carries to 2020), which is part of the overall center that is shadow anchored by Costco and Lowe's (Lowe's, a viable triple net lease property to consider).

Creekview Center is a 136,000 square foot, leased, grocery-anchored shopping center that was constructed in 2001. This commercial real estate is anchored by a 49,000 square foot Genuardi's Supermarket (Safeway) (lease expires in 2021). This leased grocery-anchored shopping center is located in Warrington, Pennsylvania, a suburb of Philadelphia. This net lease property is shadow anchored by a Target and a Lowe's Home Improvement Warehouse. Other major tenant leases are for Bed Bath & Beyond and LA Fitness.

Sunrise Plaza is anchored by a 131,000 square foot Home Depot (lease expires 2038), a 96,000 square foot, net lease Kohl's Department Store (lease expires in 2029), and a 20,000 square foot Staples. These net leased properties may be triple net leased properties and non recourse loans could be available on these net lease investments. Sunrise Plaza is located in Forked River, New Jersey, approximately 55 miles east of Philadelphia. Sunrise Plaza is a 254,000 square foot new format retail center and was constructed in 2007.

Monroe Marketplace is the other commercial real estate investment in this portfolio. This net lease property is located in Sellinsgrove, PA, which is located in central Pennsylvania along the Susquehanna River. This 335,000 square foot, leased, grocery-anchored shopping center that was constructed in 2008. Monroe Marketplace is anchored by a 76,000 square foot Giant Supermarket with a lease until 2028. This net lease investment also has a 68,000 square foot Kohl's Department Store with a lease until 2029. The net lease investment is shadow anchored by a 127,000 square foot Target. Other major tenants at the subject property

include Best Buy, Dick's Sporting Goods, Bed Bath & Beyond, Michael's and PetSmart.

If you are considering purchasing Commercial Real Estate or a Net Leased Property, you can consider getting a Mezzanine Loan. Mezzanine Financing and Non Recourse Loans are available through Commercial Loans at Loanrise.com.

The five net lease properties include the following:

New River Valley Center is located in Christiansburg, Virginia, approximately 55 miles north of the Virginia / North Carolina state border. This leased retail center is in close proximity to Virginia Tech University. New River Valley is a 165,000 square foot new format retail center which was built in 2007. The tenants at the property include a 30,000 square foot Best Buy (lease carries to 2018), Old Navy, Ross Dress for Less, Bed Bath & Beyond, Staples, and PetSmart.

Pitney Road Plaza is located in Lancaster, Pennsylvania, which is situated midway between Philadelphia and Harrisburg Pennsylvania. Pitney Road Plaza is a new format, leased retail center and was constructed in 2009. The commercial real estate acquired is a 46,000 square foot freestanding Best Buy (lease carries to 2020), which is part of the overall center that is shadow anchored by Costco and Lowe's (Lowe's, a viable triple net lease property to consider).

Creekview Center is a 136,000 square foot, leased, grocery-anchored shopping center that was constructed in 2001. This commercial real estate is anchored by a 49,000 square foot Genuardi's Supermarket (Safeway) (lease expires in 2021). This leased grocery-anchored shopping center is located in Warrington, Pennsylvania, a suburb of Philadelphia. This net lease property is shadow anchored by a Target and a Lowe's Home Improvement Warehouse. Other major tenant leases are for Bed Bath & Beyond and LA Fitness.

Sunrise Plaza is anchored by a 131,000 square foot Home Depot (lease expires 2038), a 96,000 square foot, net lease Kohl's Department Store (lease expires in 2029), and a 20,000 square foot Staples. These net leased properties may be triple net leased properties and non recourse loans could be available on these net lease investments. Sunrise Plaza is located in Forked River, New Jersey, approximately 55 miles east of Philadelphia. Sunrise Plaza is a 254,000 square foot new format retail center and was constructed in 2007.

Monroe Marketplace is the other commercial real estate investment in this portfolio. This net lease property is located in Sellinsgrove, PA, which is located in central Pennsylvania along the Susquehanna River. This 335,000 square foot, leased, grocery-anchored shopping center that was constructed in 2008. Monroe Marketplace is anchored by a 76,000 square foot Giant Supermarket with a lease until 2028. This net lease investment also has a 68,000 square foot Kohl's Department Store with a lease until 2029. The net lease investment is shadow anchored by a 127,000 square foot Target. Other major tenants at the subject property

include Best Buy, Dick's Sporting Goods, Bed Bath & Beyond, Michael's and PetSmart.

Net Lease Properties & Commercial Loans

If a Net Lease Property is of interest to you then contact us, HERE. We can assist you with your search for Net Lease Property Investments. Some examples of net leased properties to purchase are a CVS, FedEx, Walgreen's, Target, Publix or a property net leased to McDonald's, Dollar General, Burger King, Wendy's or Taco Bell.If you are considering purchasing Commercial Real Estate or a Net Leased Property, you can consider getting a Mezzanine Loan. Mezzanine Financing and Non Recourse Loans are available through Commercial Loans at Loanrise.com.

Monday, August 23, 2010

Net Lease Investments Sold in California

Greenwich, Connecticut - Net Lease Properties news today is on the sale of 4 California, Net Lease Investments. Hanover Real Estate Partners, which is a privately held real estate investment company sold four California properties on behalf of its affiliate, Dexter Street Limited Partnership. Hanover Real Estate Partners is focused on owning, managing and operating institutional grade commercial real estate assets across the country.

3 of commercial real estate investments sold were located in the San Diego area. The other commercial real estate investment was in Stockton, California.

The mix of commercial real estate sold was a total of nearly 300,000 square feet. It included a 200,000 square foot three-story office building, two approximately 6,000 square-foot retail bank branches, and a seven-story, 89,000-square-foot office building.

The 2, net lease investment properties included in this transaction are leased to Wells Fargo Bank. One net leased property is a 5,100 square foot retail bank branch located at 2751 Via de la Valle, in Del Mar. The other net lease investment property is a 6,000 square foot retail bank branch located at 16901 Bernardo Center Drive, in Rancho Bernardo.

The leased office building is located in Stockton and serves as the corporate headquarters for In Shape Health Clubs. This leased office building features a state of the art fitness center on the ground floor. The sale follows the successful re-leasing and re-positioning of each commercial real estate investment.

If you are considering purchasing Commercial Real Estate or a Triple Net Leased Property, you can consider getting a Mezzanine Loan. Mezzanine Financing and Non Recourse Loans are available through Commercial Loans at Loanrise.com.

Here are some of the Retail Single Tenants that may be available as a Net Lease Investment or Triple Net Lease Property:

•AutoZone Net Lease Investment

•Burger King Net Lease Investment

•Costco Net Lease Investment

•CVS Net Lease Investment

•FedEx Net Lease Investment (Federal Express Net Lease Investment)

•Home Depot Net Lease Investment

•Kohl’s Net Lease Investment

•Kroger Net Lease Investment

•Lowe’s Net Lease Investment

•McDonald’s Net Lease Investment

•Oreilly’s Net Lease Investment

•Publix Net Lease Investment

•Safeway Net Lease Investment

•Staples Net Lease Investment

•Steak n' Shake Net Lease Investment

•Target Net Lease Investment

•Walgreens Net Lease Investment

•Wal-Mart Net Lease Investment

•Wendy's Net Lease Investment

3 of commercial real estate investments sold were located in the San Diego area. The other commercial real estate investment was in Stockton, California.

The mix of commercial real estate sold was a total of nearly 300,000 square feet. It included a 200,000 square foot three-story office building, two approximately 6,000 square-foot retail bank branches, and a seven-story, 89,000-square-foot office building.

The 2, net lease investment properties included in this transaction are leased to Wells Fargo Bank. One net leased property is a 5,100 square foot retail bank branch located at 2751 Via de la Valle, in Del Mar. The other net lease investment property is a 6,000 square foot retail bank branch located at 16901 Bernardo Center Drive, in Rancho Bernardo.

The leased office building is located in Stockton and serves as the corporate headquarters for In Shape Health Clubs. This leased office building features a state of the art fitness center on the ground floor. The sale follows the successful re-leasing and re-positioning of each commercial real estate investment.

Net Lease Properties & Commercial Loans

If a Net Lease Property is of interest to you then contact us, HERE. We can assist you with your search for Net Lease Property Investments. Some examples of net leased properties to purchase are listed below.If you are considering purchasing Commercial Real Estate or a Triple Net Leased Property, you can consider getting a Mezzanine Loan. Mezzanine Financing and Non Recourse Loans are available through Commercial Loans at Loanrise.com.

Here are some of the Retail Single Tenants that may be available as a Net Lease Investment or Triple Net Lease Property:

•AutoZone Net Lease Investment

•Burger King Net Lease Investment

•Costco Net Lease Investment

•CVS Net Lease Investment

•FedEx Net Lease Investment (Federal Express Net Lease Investment)

•Home Depot Net Lease Investment

•Kohl’s Net Lease Investment

•Kroger Net Lease Investment

•Lowe’s Net Lease Investment

•McDonald’s Net Lease Investment

•Oreilly’s Net Lease Investment

•Publix Net Lease Investment

•Safeway Net Lease Investment

•Staples Net Lease Investment

•Steak n' Shake Net Lease Investment

•Target Net Lease Investment

•Walgreens Net Lease Investment

•Wal-Mart Net Lease Investment

•Wendy's Net Lease Investment

Saturday, August 21, 2010

REIT Aquires Leasehold interest in 1717 Arch Street

Philadelphia. Pennsylvania – Net Lease Properties has news on a major Commercial Real Estate transaction. Brandywine Realty Trust has purchased the leasehold interest in 1717 Arch Street, in Philadelphia. Brandywine Realty Trust is a huge, publicly traded, integrated real estate company organized as a real estate investment trust (REIT).

1717 Arch Street is a 1,029,400 square foot, 53-story, class A office tower located in the business district of Philadelphia.

This leased property is currently 63% leased and has a 309 space parking garage. The commercial real estate skyscraper is subject to a long-term land lease with Verizon, which has been prepaid through August 2022 and which can be extended through 2092. Verizon, also has signed a space lease for 121,945 square feet which takes floors two through seven of the leased skyscraper. Comcast signed a sublease for the 42nd and 43rd floors at 1717 Arch Street which amounts to a total of 42,230 square feet.

Comcast, founded in 1963, is the largest cable operator and home Internet service provider in the United States. This is an attractive Net Lease Investment with having tenants like Comcast and Verizon leasing from you.

The seller was an affiliate of The Blackstone Group. This commercial real estate was previously known as Bell Atlantic Tower. The REIT paid $129.0 million, or $125 per square foot, for this net leased investment.

Brandywine owns, develops, manages and has ownership interests in a primarily Class A, office portfolio comprising 320 properties and 34.4 million square feet.

This commercial real estate purchase of this net lease investment reflects a fine opportunity to further the investment strategy of the REIT by acquiring value-added situations in select markets.

Net Lease Properties & Commercial Loans

If a Net Lease Property is of interest to you then contact us, HERE. We can assist you with your search for Net Lease Property Investments. Some examples of net leased properties to purchase are a CVS, FedEx, Walgreen's, Target, Publix or a property net leased to McDonald's, Dollar General, Burger King, Wendy's or Taco Bell.If you are considering purchasing Commercial Real Estate or a Net Leased Property, you can consider getting a Mezzanine Loan. Mezzanine Financing and Non Recourse Loans are available through Commercial Loans at Loanrise.com.

Friday, August 20, 2010

Healthcare Net Lease Properties

Long Beach, California - Net Lease Properties has information on a real estate investment trust (REIT) with investments in Healthcare related commercial real estate. Healthcare is currently, the single largest industry in the U.S. based on Gross Domestic Product ("GDP"). HCP, Inc. (HCP) is a Company, based in Long Beach, that invests primarily in commercial real estate serving the healthcare industry in the United States.

The HCP REIT has some recent acquisitions to add to their commercial real estate portfolio. They acquired a life science facility and two medical office buildings for approximately $48 million. The life science facility, a net lease property, is made up 85,000 rentable square feet. This net lease property is occupied by a single tenant under a 15-year triple-net lease. The medical office buildings are a combined 103,000 rentable square feet and are currently 95% occupied.

Recent quarters have revenue climbing at the health-care (HCP) real estate investment trust, the largest by market capitalization, as occupancies improve for their net lease properties.

Most health care REITs invest in various mixes of senior housing, medical office buildings (some with net leases), life science, laboratories and hospital assets. We have seen senior housing facilities which are triple net leased to third-party operators. These product types have varying degrees of upside, with steady cash flow given the nation’s aging Baby Boom population and its need for long-term medical care.

Net leased to a single tenant or otherwise, healthcare net lease properties seem to be one of the preferred asset types for Commercial Real Estate Investors and REITs.

The HCP REIT has some recent acquisitions to add to their commercial real estate portfolio. They acquired a life science facility and two medical office buildings for approximately $48 million. The life science facility, a net lease property, is made up 85,000 rentable square feet. This net lease property is occupied by a single tenant under a 15-year triple-net lease. The medical office buildings are a combined 103,000 rentable square feet and are currently 95% occupied.

Recent quarters have revenue climbing at the health-care (HCP) real estate investment trust, the largest by market capitalization, as occupancies improve for their net lease properties.

Most health care REITs invest in various mixes of senior housing, medical office buildings (some with net leases), life science, laboratories and hospital assets. We have seen senior housing facilities which are triple net leased to third-party operators. These product types have varying degrees of upside, with steady cash flow given the nation’s aging Baby Boom population and its need for long-term medical care.

Net leased to a single tenant or otherwise, healthcare net lease properties seem to be one of the preferred asset types for Commercial Real Estate Investors and REITs.

Net Lease Properties & Commercial Loans

If a Medical Office Building is of interest to you then contact us, HERE. We can also assist you with your Commercial Loans and Net Lease Properties Funding to purchase a CVS, FedEx, Walgreens, Target, Publix or a property net leased to McDonald's, Dollar General, Wendy's, Burger King or Taco Bell.Thursday, August 19, 2010

Net Lease Properties Information

North Palm Beach, Florida - Net Lease Properties are becoming the highly desired investment vehicle for Commercial Real Estate Investors. We are seeing many Real Estate Investment Trusts (REIT) and foreign Investors gobbling up available net lease properties.

A net lease property investment is under contract whereas the lessee is bound by to pay any expenses related to the ownership of the property, including but not limited to utility bills, building repairs, annual taxes and insurance needs. Triple Net Lease Properties "NNN" are still our most desired investment holdings, as explained below.

A triple net lease (Net-Net-Net or NNN) is a lease agreement on a property where the tenant or lessee agrees to pay all real estate taxes, building insurance, and maintenance (the three 'Nets') on the property in addition to any normal fees that are expected under the agreement (rent, etc.). In such a lease, the tenant or lessee is responsible for all costs associated with the repair and maintenance of any common area of that particular Net Lease Property.

Net Lease Properties & Commercial Loans

If a Net Lease Property is of interest to you then contact us, HERE. We can also assist you with your Commercial Loans for Net Lease Properties purchases. Some examples of net leased properties to purchase are a CVS, FedEx, Walgreens, Target, Publix or a property net leased to McDonald's, Dollar General, Burger King or Taco Bell.Wednesday, August 18, 2010

Net Leased CVS Property Sold

Lake in the Hills, Illinois - Net Lease Properties news today is on the acquisition of a property that is net leased to CVS. Agree Realty Corporation has purchased a retail property that is net leased to CVS/Caremark Corporation.

This net lease property is located at the intersection of West Algonquin Road and Lakewood Road in Lake in the Hills, Illinois. Lake in the Hills (often abbreviated L.I.T.H. or LITH) is a village in McHenry County, Illinois. There are many different townships for this area of Illinois if you are searching for commercial real estate property information.

The cost of this Commercial Real Estate acquisition was approximately $5,800,000. CVS has approximately 24 years remaining on the base term of the lease. The square footage of the property is approximately 12,900. County records indicate this net lease property was originally a sale-leaseback which is common amongst many net lease properties with credit tenants.

The new owners are purchasing primarily single tenant properties, leased to major retail tenants and neighborhood community shopping centers.

This net lease property is located at the intersection of West Algonquin Road and Lakewood Road in Lake in the Hills, Illinois. Lake in the Hills (often abbreviated L.I.T.H. or LITH) is a village in McHenry County, Illinois. There are many different townships for this area of Illinois if you are searching for commercial real estate property information.

The cost of this Commercial Real Estate acquisition was approximately $5,800,000. CVS has approximately 24 years remaining on the base term of the lease. The square footage of the property is approximately 12,900. County records indicate this net lease property was originally a sale-leaseback which is common amongst many net lease properties with credit tenants.

The new owners are purchasing primarily single tenant properties, leased to major retail tenants and neighborhood community shopping centers.

Net Lease Properties & Commercial Loans

If a Multifamily Apartment Complex is of interest to you then contact us, HERE. We can also assist you with your Commercial Loans and Net Lease Properties Funding to purchase a CVS, FedEx, Walgreens, Target, Publix or a property net leased to McDonald's, Dollar General, Burger King or Taco Bell.Monday, August 16, 2010

A Net Lease Renewed For LexisNexis in Boca Raton

Boca Raton, Florida – Net Lease Properties has news from beautiful Boca Raton, Florida. LexisNexis has a new net lease renewal at the Meridian Commercial office complex. This net lease is a 10 year, $13 million lease. This location at the Arvida Park of Commerce, is close to the I-95 exit for Yamato Road. It is located at 6601 Park of Commerce Boulevard, Boca Raton. This is very close to the Boca Raton Panera Bread on Yamato.

This area of Boca Raton can get anywhere from $14 to $17 per square foot for triple net lease properties. We did see some smaller Office space with a triple net lease available under $14 per square foot.

The landlord of the Meridian Commercial office complex is a pension fund advisor based in New York known as Granite Meridian, LLC.

LexisNexis has the entire, 61,524 square foot building under lease. LexisNexis is a strong, credit tenant, one of the best in Boca Raton. They thought it was better to stay put then to move their entire Office facilities to a new net lease property.

The net lease property is located within minutes from Florida Atlantic University, fine Restaurants and Shopping.

LexisNexis is a leading global provider of content-enabled workflow solutions designed specifically for professionals in the legal, risk management, corporate, government, law enforcement, accounting, and academic markets. A member of Reed Elsevier, LexisNexis serves customers in more than 100 countries with more than 15,000 employees worldwide.

This area of Boca Raton can get anywhere from $14 to $17 per square foot for triple net lease properties. We did see some smaller Office space with a triple net lease available under $14 per square foot.

The landlord of the Meridian Commercial office complex is a pension fund advisor based in New York known as Granite Meridian, LLC.

LexisNexis has the entire, 61,524 square foot building under lease. LexisNexis is a strong, credit tenant, one of the best in Boca Raton. They thought it was better to stay put then to move their entire Office facilities to a new net lease property.

The net lease property is located within minutes from Florida Atlantic University, fine Restaurants and Shopping.

LexisNexis is a leading global provider of content-enabled workflow solutions designed specifically for professionals in the legal, risk management, corporate, government, law enforcement, accounting, and academic markets. A member of Reed Elsevier, LexisNexis serves customers in more than 100 countries with more than 15,000 employees worldwide.

Net Lease Properties & Commercial Loans

If a Multifamily Apartment Complex is of interest to you then contact us, HERE. We can also assist you with your Commercial Loans and Net Lease Funding to purchase a CVS, FedEx, Walgreens, Target, Publix or another Net Lease Property.Sunday, August 15, 2010

Net Lease Properties & 1031 Exchange Conference

New York - Net Lease Properties has news on an upcoming event for players in the net lease properties, 1031 and sale leaseback markets.

France Publications and its InterFace Conference Group will bring together all of the leading players in the net lease, 1031 and sale leaseback markets for InterFace Net Lease, a national networking conference in New York City on September 23rd (cocktail reception to be held the night before on September 22nd). Organized by InterFace Vice President Rich Kelley, who has produced national net lease conference events for more than 10 years, InterFace Net Lease will focus on:

If you are active in the net lease properties, 1031 and sale leaseback markets, there is somewhere you need to be on September 23rd — InterFace Net Lease!

Contact Information:

Richard Kelley

Vice President, InterFace Conference Group

Phone: 914-468-0818

Email: rkelley@francepublications.com

France Publications and its InterFace Conference Group will bring together all of the leading players in the net lease, 1031 and sale leaseback markets for InterFace Net Lease, a national networking conference in New York City on September 23rd (cocktail reception to be held the night before on September 22nd). Organized by InterFace Vice President Rich Kelley, who has produced national net lease conference events for more than 10 years, InterFace Net Lease will focus on:

- What net lease lenders are active in the current debt market and how have the financing terms changed over the past year?

- Who are the most active equity investors and what strategies are they pursuing in this market?

- With new single tenant construction at a cyclical low, what will drive the supply pipeline in the first half of 2011?

- What is potential impact of carried interest legislation on net lease and 1031 investment markets?

- What is the current state of the 1031 market and when will it recover?

- What potential tax and accounting changes could impact on the sale leaseback market?

- As foreclosures accelerate, will zero cash flow 1031 exchanges become more prevalent?

- How will retailers’ ‘new urbanism’ impact net lease investment market?

If you are active in the net lease properties, 1031 and sale leaseback markets, there is somewhere you need to be on September 23rd — InterFace Net Lease!

Contact Information:

Richard Kelley

Vice President, InterFace Conference Group

Phone: 914-468-0818

Email: rkelley@francepublications.com

Saturday, August 14, 2010

A Walgreen's Net Lease Investment Sells For $9.2 Mil

Barrington, Illinois - Net Lease Properties news for the weekend is regarding a Walgreen’s. The free standing Walgreen’s, net lease investment sold for one of the highest prices in 2010. A net leased investment brokerage company, Boulder Group worked on putting this transaction together. This single tenant, net lease property is located at 189 Northwest Highway in Barrington, Illinois.

The buyer of this net leased Walgreen’s was a California commercial real estate investor and the sale price was $9.275 million. This retail property, free standing building is approximately 14,490 square feet and was newly constructed in one of the wealthiest area near Chicago. The Barrington zip code 60010 is the seventh wealthiest zip code in the country as recent reports state.

The net lease property sits on one of the most heavily trafficked roads of the Chicago suburbs. A retail property, net leased to a credit tenant with a long term lease, in a great area and that makes for a very worthy net lease property investment.

Across the street from this net leased Walgreen’s is a newly constructed Chase Bank and other national retailers. There is a new retail development called the Shops at Flint Creek, located just south of this Walgreens. The Shops at Flint Creek is anchored by Staples and also has a Bank of America.

The buyer of this net leased Walgreen’s was a California commercial real estate investor and the sale price was $9.275 million. This retail property, free standing building is approximately 14,490 square feet and was newly constructed in one of the wealthiest area near Chicago. The Barrington zip code 60010 is the seventh wealthiest zip code in the country as recent reports state.

The net lease property sits on one of the most heavily trafficked roads of the Chicago suburbs. A retail property, net leased to a credit tenant with a long term lease, in a great area and that makes for a very worthy net lease property investment.

Across the street from this net leased Walgreen’s is a newly constructed Chase Bank and other national retailers. There is a new retail development called the Shops at Flint Creek, located just south of this Walgreens. The Shops at Flint Creek is anchored by Staples and also has a Bank of America.

Net Lease Properties & Commercial Loans

If a Multifamily Apartment Complex is of interest to you then contact us, HERE. We can also assist you with your Commercial Loans and Net Lease Funding to purchase a CVS, FedEx, Walgreens, Target, Publix or an Industrial property.Friday, August 13, 2010

Net Leased Properties Portfolio Sold For $38.5 M

North Palm Beach, Florida - Net Lease Properties has information on a huge deal that has closed. A commercial real estate portfolio made up of net lease properties had 8 properties sold out of 11. The buyer was American Realty Capital Trust, Inc. and the seller of the net lease properties was the California State Automobile Association.

The aggregate purchase price for the eight net leased properties was approximately $38.5 million. American Realty Capital Trust (ARCT) funded the acquisitions of the properties with net proceeds received from the sale of its common stock. As of August 11, 2010, it had raised approximately $299,177,033 total gross proceeds in connection with its initial public

offering.

American Realty Capital is a commercial real estate advisory firm that invests in single-tenant, freestanding properties throughout the United States, that are net-leased on a long-term basis to investment-grade and other creditworthy tenants.

A description of the (8) Net Leased Properties purchased:

(1) CVS Pharmacy - This property is a free standing, retail store net leased to CVS located in Decatur, Georgia. The property contains 13,137 square feet of gross leaseable area. The lease is a triple net lease whereby CVS is required to pay substantially all operating expenses, including all costs to maintain and repair the roof and structure of the building, and the cost of all capital expenditures, in addition to base rent.

(5) Walgreens Stores - This portion of the net lease portfolio is five freestanding, pharmacies net leased to Walgreens. These commercial real estate investments are located in Austin, Texas, Chelsea, Alabama, Joliet, Illinois, Marysville, Ohio and Upper Arlington, Ohio. The leases are triple net whereby Walgreens is required to pay substantially all operating expenses.

(2) Fifth Third Bank Properties - This was a purchase of two free standing, fee simple bank branches for Fifth Third located in Montgomery, Illinois and Schaumburg, Illinois. The leases contain rent escalations of 10% every five years. The leases are triple net leases whereby Fifth Third is required to pay substantially all operating expenses.

The aggregate purchase price for the eight net leased properties was approximately $38.5 million. American Realty Capital Trust (ARCT) funded the acquisitions of the properties with net proceeds received from the sale of its common stock. As of August 11, 2010, it had raised approximately $299,177,033 total gross proceeds in connection with its initial public

offering.

American Realty Capital is a commercial real estate advisory firm that invests in single-tenant, freestanding properties throughout the United States, that are net-leased on a long-term basis to investment-grade and other creditworthy tenants.

A description of the (8) Net Leased Properties purchased:

(1) CVS Pharmacy - This property is a free standing, retail store net leased to CVS located in Decatur, Georgia. The property contains 13,137 square feet of gross leaseable area. The lease is a triple net lease whereby CVS is required to pay substantially all operating expenses, including all costs to maintain and repair the roof and structure of the building, and the cost of all capital expenditures, in addition to base rent.

(5) Walgreens Stores - This portion of the net lease portfolio is five freestanding, pharmacies net leased to Walgreens. These commercial real estate investments are located in Austin, Texas, Chelsea, Alabama, Joliet, Illinois, Marysville, Ohio and Upper Arlington, Ohio. The leases are triple net whereby Walgreens is required to pay substantially all operating expenses.

(2) Fifth Third Bank Properties - This was a purchase of two free standing, fee simple bank branches for Fifth Third located in Montgomery, Illinois and Schaumburg, Illinois. The leases contain rent escalations of 10% every five years. The leases are triple net leases whereby Fifth Third is required to pay substantially all operating expenses.

Net Lease Properties & Non Recourse Commercial Loans

If you feel this is the right time to invest in Commercial Real Estate, Multi-Family Apartment Buildings, Shopping Centers or Net Lease Properties then contact us, HERE. We can also assist you with your Non Recourse Loan and Net Lease Funding to purchase a CVS, Walgreens, Target, Publix, Kohl's, Burger King, KFC, Wendy's or other Net Lease Property.Thursday, August 12, 2010

2 Net Leased Properties Purchased by REIT

Kansas City, Missouri - Today, Net Lease Properties news is on Properties acquired by a REIT. The first property which was purchased is net leased to Kohl’s Department Stores, Inc. through January 31, 2025 (with tenant options to extend). This net lease property is located in Kansas City and the purchase price was $8.95 million. This net leased Kohl's is in the Wilshire Plaza Shopping Center, which is anchored by the commercial real estate investments, Super Target and Home Depot.

This Kohl's is approximately 88,248 square feet, a retail department store on approximately 7.47 acres.

The other net leased property that was purchased is located in Monroeville, Pennsylvania, a suburb of Pittsburgh. This commercial real estate investment is a 6,000 square foot retail property leased by a Men's Wearhouse pursuant to a long term net lease. The purchase price was approximately $1.3 million, including $300,000 of contracted building improvements.

The Buyer of both of these net lease properties was One Liberty. One Liberty is a New York based real estate investment trust (REIT) that specializes in the acquisition of real estate properties under long term net leases.

This Kohl's is approximately 88,248 square feet, a retail department store on approximately 7.47 acres.

The other net leased property that was purchased is located in Monroeville, Pennsylvania, a suburb of Pittsburgh. This commercial real estate investment is a 6,000 square foot retail property leased by a Men's Wearhouse pursuant to a long term net lease. The purchase price was approximately $1.3 million, including $300,000 of contracted building improvements.

The Buyer of both of these net lease properties was One Liberty. One Liberty is a New York based real estate investment trust (REIT) that specializes in the acquisition of real estate properties under long term net leases.

Net Lease Properties & Non Recourse Loans

If you feel this is the right time to invest in Commercial Real Estate, Multi-Family Apartment Buildings, Shopping Centers or Net Lease Properties then contact us, HERE. We can also assist you with your Non Recourse Loan and Net Lease Funding to purchase a CVS, Walgreens, Target, Publix, Kohl's, Burger King, KFC, Wendy's or other Net Lease Property.Wednesday, August 11, 2010

Net Leased Shopping Center with Publix Anchor Sold

St. Cloud, Florida - Net Lease Properties news for Wednesday, August 11, 2010 is regarding one of our favorite net leased properties. Publix was founded in 1930, and is one of the largest and fastest-growing employee-owned supermarket chains in the United States.

Inland Real Estate Acquisitions, Inc. has purchased the grocery-anchored shopping center in St. Cloud, Florida. The shopping center known as the Publix Shopping Center was acquired for $9.363 million. This commercial real estate investment was constructed in 2003.

This net leased 78,820 square-foot Publix Shopping Center is currently 100% leased. Anchored by Publix Super Markets, Inc., which is the dominant supermarket chain operating in Florida. Publix has proven to be a very strong anchor for this shopping center.

The net leased property is located across from a Wal-Mart Supercenter and a Home Depot. This St. Cloud shopping center is approximately 20 miles south of the Orlando International Airport.

The Publix Shopping Center is leased to sixteen tenants. With this net lease, each tenant is required to pay its proportionate share of real estate taxes, insurance and common area maintenance costs. Publix, the anchor tenant of this property pays an annual base rent of approximately $536,000 under a lease that expires in October 2023.

Inland Real Estate Acquisitions, Inc. has purchased the grocery-anchored shopping center in St. Cloud, Florida. The shopping center known as the Publix Shopping Center was acquired for $9.363 million. This commercial real estate investment was constructed in 2003.

This net leased 78,820 square-foot Publix Shopping Center is currently 100% leased. Anchored by Publix Super Markets, Inc., which is the dominant supermarket chain operating in Florida. Publix has proven to be a very strong anchor for this shopping center.

The net leased property is located across from a Wal-Mart Supercenter and a Home Depot. This St. Cloud shopping center is approximately 20 miles south of the Orlando International Airport.

The Publix Shopping Center is leased to sixteen tenants. With this net lease, each tenant is required to pay its proportionate share of real estate taxes, insurance and common area maintenance costs. Publix, the anchor tenant of this property pays an annual base rent of approximately $536,000 under a lease that expires in October 2023.

Net Lease Properties & Non Recourse Loans

If you feel this is the right time to invest in Commercial Real Estate, Multi-Family Apartment Buildings, Shopping Centers or Net Lease Properties then contact us, HERE. We can also assist you with your Non Recourse Loan and Net Lease Funding to purchase a new property.Tuesday, August 10, 2010

Fortune International Management Sells Miami Hotel

Miami Beach, Florida- Net Lease Properties news for today is coming from the Hotel Business in Miami Beach. The Seville Hotel has been purchased by the famous hotelier Ian Schrager and Marriott for $57.5 million. Marriott has plans to redevelop the hotel into a boutique brand called Edition. The Seville Hotel is a 12-story, 400-room commercial real estate property. The Hotel has The 278,547 square-feet and was built in 1955.

The previous owner of this Commercial Real Estate was 2901 Beach Ventures, which consisted of two equal partners, Lionstone Group and Fortune International Management. A partner with Arnstein & Lehr, lead the negotiations for the Sellers Group regarding the underlying loan with FirstBank Puerto Rico that resulted in the sale of the Seville Hotel to Marriott and hotelier Ian Schrager. The purchase price for the Hotel was for $57.5 million. We believe this was a Short Sale with almost $10 million being dismissed from the first mortgage value.

The famous hotelier, Ian Schrager, helped restart South Beach with his launch of the Delano hotel 15 years ago. Ian Schrager left Miami Beach a few years ago with the sale of his interest in the Morgans Hotel Group.

It is rare to find any net lease properties in Miami Beach. We do see a Retail Property, Free Standing Building as a Net Lease Investment with 10+ years left on the lease, in Miami. The Net Lease Property is marketed as a 8.50% Cap Rate.

The previous owner of this Commercial Real Estate was 2901 Beach Ventures, which consisted of two equal partners, Lionstone Group and Fortune International Management. A partner with Arnstein & Lehr, lead the negotiations for the Sellers Group regarding the underlying loan with FirstBank Puerto Rico that resulted in the sale of the Seville Hotel to Marriott and hotelier Ian Schrager. The purchase price for the Hotel was for $57.5 million. We believe this was a Short Sale with almost $10 million being dismissed from the first mortgage value.

The famous hotelier, Ian Schrager, helped restart South Beach with his launch of the Delano hotel 15 years ago. Ian Schrager left Miami Beach a few years ago with the sale of his interest in the Morgans Hotel Group.

It is rare to find any net lease properties in Miami Beach. We do see a Retail Property, Free Standing Building as a Net Lease Investment with 10+ years left on the lease, in Miami. The Net Lease Property is marketed as a 8.50% Cap Rate.

Net Lease Properties & Non Recourse Loans

If you feel this is the right time to invest in Commercial Real Estate, Multi-Family Apartment Buildings, Major Hotels or Net Lease Properties then contact us, HERE. We can also assist you with your Non Recourse Loan and Net Lease Property Funding to purchase a new property.Monday, August 9, 2010

Non Recourse Loans on Shopping Centers

Non Recourse Loans

Bloomfield Hills, Michigan - Net Lease Properties has news for the day on Taubman Centers. Taubman is known for its focus on dominant retail malls with the highest average sales productivity in the nation. Taubman Centers is a real estate investment trust (REIT) which is headquartered in Bloomfield Hills, Michigan and its Taubman Asia subsidiary is headquartered in Hong Kong.

The new reports are regarding the non recourse loan for Arizona Mills. Located at the Arizona Mills Interchange, at the intersection of Interstate I-10 and US Highway 60 in Tempe, Arizona. The refinancing of Arizona Mills was recently completed. The terms of the refinancing are a 10-year $175 million non-recourse loan. This Commercial Loan bears interest at an all-in rate of 5.83 percent, with amortizing principal based on 30 years. Taubman will use proceeds from the refinancing to pay off the existing $131.0 million 7.90 percent loan, with excess amounts distributed to the partners.

We previously reported on the Non Recourse Loan (Click Here) for The Mall at Partridge Creek, in Clinton Township, Michigan. A brief scenario on that Non recourse loan is it was a 10-year $82.5 million non-recourse loan which bears interest at an all-in rate of 6.25 percent.

Taubman believes that conditions in the capital markets have improved over the past several months, particularly for good sponsors and good assets. They are pleased with the amount of proceeds and interest rates on these two new non recourse loans.

Second quarter reports on Taubman Centers have Tenant sales per square foot which were very strong in the quarter, up 12.1 percent, bringing the year to date increase to 11.4 percent. They are led by their centers in Michigan and Florida, more than half of their centers had sales per square foot increases in the double digits for the quarter.

Leased space for Taubman's portfolio was 90.8 percent on June 30, 2010 compared to 91.3 percent on June 30, 2009. The average rent per square foot for the second quarter of 2010 was $43.20 versus $43.40 in the second quarter of 2009.

Net Lease Properties & Non Recourse Loans

If you feel this is the right time to invest in Commercial Real Estate, Multi-Family Apartment Buildings, Shopping Centers or Net Lease Properties then contact us, HERE. We can also assist you with your Non Recourse Loan and Net Lease Funding to purchase a new property.Sunday, August 8, 2010

3 Net Lease Properties Bought by NY REIT

Great Neck, New York - Net Lease Properties has news today concerning a sale and leaseback transaction. One Liberty Properties purchased a Portfolio of three Wendy's Properties. Old Liberty obtained the three Wendy's Old Fashioned Hamburger fast food restaurants which are located in Pennsylvania in this sale and leaseback transaction. The purchase price for this portfolio is $3.84 million and the net lease is for an initial 20 year term with a nine year renewal option. The seller of these net lease properties is a franchisee and operator of more than 100 Wendy's restaurants.

One Liberty is a New York based real estate investment trust (REIT) that specializes in the acquisition and ownership of a diverse portfolio of commercial real estate properties under long term net leases. One Liberty's net leases generally provide for contractual rent increases. These properties normally have all the operating expenses and most or all other property related expenses paid by the tenant.

As an example of this intelligent investing in net lease properties can be seen in One Liberty Properties second quarter results. One Liberty's Rental income for the three months ending June 30, 2010 was $10.6 million compared to $9.7 million for the three months that ended June 30, 2009. Rental income increases were due to the effect of acquisitions, as well as increased revenues associated with lease revisions within the existing portfolio.

One Liberty is a New York based real estate investment trust (REIT) that specializes in the acquisition and ownership of a diverse portfolio of commercial real estate properties under long term net leases. One Liberty's net leases generally provide for contractual rent increases. These properties normally have all the operating expenses and most or all other property related expenses paid by the tenant.

As an example of this intelligent investing in net lease properties can be seen in One Liberty Properties second quarter results. One Liberty's Rental income for the three months ending June 30, 2010 was $10.6 million compared to $9.7 million for the three months that ended June 30, 2009. Rental income increases were due to the effect of acquisitions, as well as increased revenues associated with lease revisions within the existing portfolio.

Net Lease Properties & Commercial Real Estate Financing

If Shopping Centers, Net Lease Properties or Apartment Buildings are of interest to you then contact us, HERE. We can also assist you with your Commercial Real Estate Mortgage and Net Lease Funding to purchase a CVS, Walgreens, Target, Publix, Wendy's or other Net Lease property.Saturday, August 7, 2010

Commercial Real Estate News For South Florida

Palm Beach Gardens, Florida - Net Lease Properties news today centers around commercial real estate in south east Florida. First of all, a retail strip center in Palm Beach Gardens sold. This retail strip center has sold for $740,000. It is known as Clocktower Plaza as is located at 4203-4241 Northlake Boulevard, just west of the I-95 exit. This strip center sits behind a Gas Station at Northlake Boulevard and Keating Drive.

Reports are that this retail strip center was on the market only 22 days before going under contract.

We are not seeing too many Net Leased Properties for sale, in this area. An Office Building

Strip Center, Net Lease Investment with 3 years left on the lease, is being marketed in Lake Park, Florida.

For next bit of Commercial Real Estate News, we travel down to Pembroke Pines, Florida. Pembroke Pines sits west of Fort Lauderdale and Hollywood, not far from Miami Beach Commercial Real Estate investments.

The Taft Retail Center sold for $734,000. The Taft Retail Center is located at 1591 NW 77th Way in Pembroke Pines and is 6,700 square feet. The seller was a local private trust and sold the property to a foreign investor.

The property was built in 1973, and is currently 100% leased. The leases are to three long-term tenants. Taft Market & Deli leases a portion of the property as does Angie's Pet Spa & Boutique, and Bitter Blue Lawn & Garden.

This area currently has a net leased property, that is an Office Building being marketed.

Reports are that this retail strip center was on the market only 22 days before going under contract.

We are not seeing too many Net Leased Properties for sale, in this area. An Office Building

Strip Center, Net Lease Investment with 3 years left on the lease, is being marketed in Lake Park, Florida.

For next bit of Commercial Real Estate News, we travel down to Pembroke Pines, Florida. Pembroke Pines sits west of Fort Lauderdale and Hollywood, not far from Miami Beach Commercial Real Estate investments.

The Taft Retail Center sold for $734,000. The Taft Retail Center is located at 1591 NW 77th Way in Pembroke Pines and is 6,700 square feet. The seller was a local private trust and sold the property to a foreign investor.

The property was built in 1973, and is currently 100% leased. The leases are to three long-term tenants. Taft Market & Deli leases a portion of the property as does Angie's Pet Spa & Boutique, and Bitter Blue Lawn & Garden.

This area currently has a net leased property, that is an Office Building being marketed.

Net Lease Properties & Financing

If Shopping Centers, Net Lease Properties or Apartment Buildings are of interest to you then contact us, HERE. We can also assist you with your Commercial Real Estate Mortgage and Net Lease Funding to purchase a CVS, Walgreens, Target, Publix or other Net Lease property.Friday, August 6, 2010

Triple Net Lease Property Sold for $3.1 Mil

Westminster, Colorado - Net Lease Properties News for the day comes from Colorado. The Triple Net Investment that sold was Orchard Town Center, located in in Westminster. The Net Lease Investment is a 5,811-square-foot retail building and sold for $3.08 million.

This Commercial Real Estate property was built in 2008, and is 100% occupied. One by Starbucks Drive-Thru through the first quarter of 2018, Qwest through the fourth quarter of 2018 and T-Mobile through the fourth quarter of 2012. The multi-tenant, retail building has a triple-net lease with Starbucks Drive-Thru through the first quarter of 2018. Another triple net lease with Qwest through the fourth quarter of 2018. The 3rd net lease is with T-Mobile through the fourth quarter of 2012.

A Net Lease Property that is 100% occupied to strong, national credit tenants on long term leases, is an attractive investment in commercial real estate.

This triple net leased property was part of a 1031 exchange. We believe we will see many more 1031 tax free exchange deals in the next 2 years.

This Net Leased Property is located at the interchange of 144th Avenue and I-25.

This path is one of Colorado' s most traveled freeways and the major north-south thoroughfare between New Mexico and Wyoming. The net leased, multi-tenant, retail building is located at one of the busiest intersections in the Metro Denver areas. Westminster is one Colorado's fastest growing communities.

This Commercial Real Estate property was built in 2008, and is 100% occupied. One by Starbucks Drive-Thru through the first quarter of 2018, Qwest through the fourth quarter of 2018 and T-Mobile through the fourth quarter of 2012. The multi-tenant, retail building has a triple-net lease with Starbucks Drive-Thru through the first quarter of 2018. Another triple net lease with Qwest through the fourth quarter of 2018. The 3rd net lease is with T-Mobile through the fourth quarter of 2012.

A Net Lease Property that is 100% occupied to strong, national credit tenants on long term leases, is an attractive investment in commercial real estate.

This triple net leased property was part of a 1031 exchange. We believe we will see many more 1031 tax free exchange deals in the next 2 years.

This Net Leased Property is located at the interchange of 144th Avenue and I-25.

This path is one of Colorado' s most traveled freeways and the major north-south thoroughfare between New Mexico and Wyoming. The net leased, multi-tenant, retail building is located at one of the busiest intersections in the Metro Denver areas. Westminster is one Colorado's fastest growing communities.

Net Lease Properties & Financing

If Multi-tenant, Retail buildings, Net Lease Properties or Apartment Buildings or a Distribution Center is of interest to you then contact us, HERE. We can also assist you with your Commercial Real Estate Mortgage and Net Lease Funding to purchase a CVS, McDonald's, Walgreens, Starbucks, Publix or other Net Lease property.Thursday, August 5, 2010

NNN Distribution Center Sold For $26.1 Mil

Coatesville, Pennsylvania - This mornings news from Net Lease Properties is on a distribution center. An entity named KS Coatesville PA sold a net lease property for $26.1 million. The Buyer was known to be a Private Investor.

The 150,000-square-foot triple net leased property is located at 201 Waverly Boulevard in Coatesville, Pennsylvania. The distribution center is approximately 45 miles West of Philadelphia.

The net lease property is 100% occupied by Keystone Foods. Keystone Foods is a global manufacturer and supplier of protein products and a custom food-service distributor. More Information on the net leased property is that it is on 20.4 acres, includes 30-foot clearance, and 35 docks. The Building also has office space, dry storage, freezer storage, cooler, cold docks and maintenance facilities.

At one point in time this Net Lease Property was being marketed as a 8.04% Cap rate.

This property, which has expansion capabilities, distributes products to more than 400 McDonald's locations throughout Pennsylvania, New Jersey and Delaware.

Coatesville represents an attractive point of distribution due to its proximity to I-76 (Pennsylvania Turnpike) and Route 30.

The 150,000-square-foot triple net leased property is located at 201 Waverly Boulevard in Coatesville, Pennsylvania. The distribution center is approximately 45 miles West of Philadelphia.

The net lease property is 100% occupied by Keystone Foods. Keystone Foods is a global manufacturer and supplier of protein products and a custom food-service distributor. More Information on the net leased property is that it is on 20.4 acres, includes 30-foot clearance, and 35 docks. The Building also has office space, dry storage, freezer storage, cooler, cold docks and maintenance facilities.

At one point in time this Net Lease Property was being marketed as a 8.04% Cap rate.

This property, which has expansion capabilities, distributes products to more than 400 McDonald's locations throughout Pennsylvania, New Jersey and Delaware.

Coatesville represents an attractive point of distribution due to its proximity to I-76 (Pennsylvania Turnpike) and Route 30.

Net Lease Properties & Financing

If Shopping Centers, Net Lease Properties or Apartment Buildings or a Distribution Center is of interest to you then contact us, HERE. We can also assist you with your Commercial Real Estate Mortgage and Net Lease Funding to purchase a CVS, McDonald's, Walgreens, Target, Publix or other Net Lease property.Wednesday, August 4, 2010

Vinings Main, Mixed-Use Development Sold For $24 MIL

Atlanta, Georgia – The Net Lease Properties news this morning is from Vinings, an area inside the Atlanta perimeter. ACG Equities Inc. purchased Vinings Main, which is a mixed-use commercial and residential condominium development in the Atlanta suburb for $24 million cash. The acquisition represents the first allocation from ACG Equities’ $150 million, Midwest-based private equity fund.

Reports are that Officials from ACG Equities said this purchase is its first in a planned series of acquisitions in recovering markets. The company’s sister firm, ACG Management, will provide an asset and property-management service platform for Vinings Main and other projects the ACG Equities’ fund acquires.

The Vinings Main project is located just inside the perimeter on Paces Ferry Road. An affluent area which is on the northwest side of Atlanta. This transaction includes 34,000 sq. ft. of office condominium space, 17,000 sq. ft. of retail space and a 461-space parking deck. Currently, the highest profile retail tenant is the Social Vinings restaurant, owned and operated by Paul Albrecht’s Great Food Group, Incorporation. Vinings Main was built at a cost of $57 million and opened in 2008. However Vinings Main was taken into foreclosure last December by its 23 lenders, after having sold only three of its 148 residential condominiums.